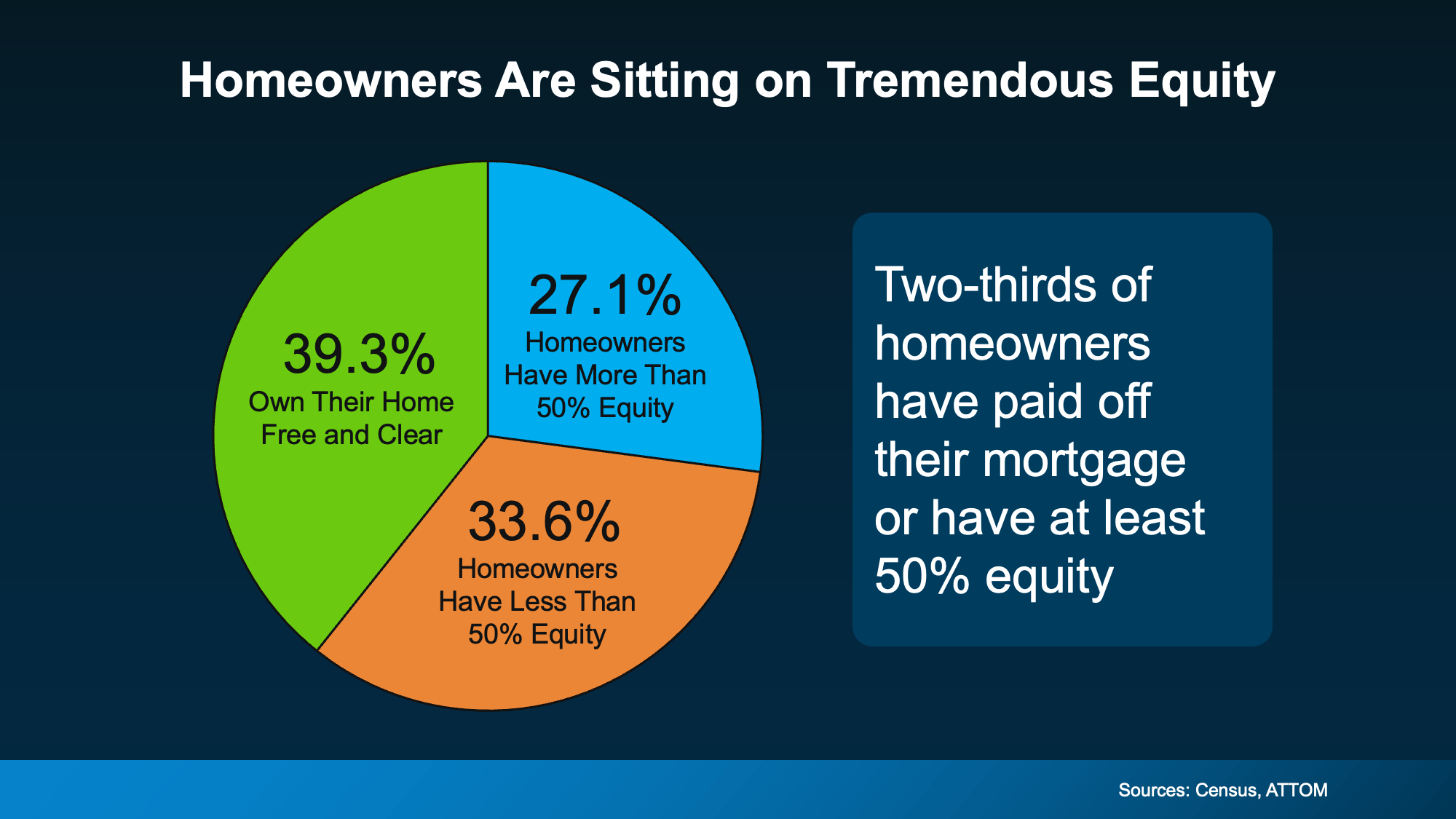

You may have heard homeowners today have a lot of equity built up. But what does that really mean? Let’s break it down.

Because your equity isn’t just a number, it’s a powerful asset that can help you take your next big step in life.

How Much Equity Does the Typical Homeowner Have?

Here’s how it works. As you pay down your loan and home prices rise through the years, the share of your home that you own free and clear grows. That’s your equity.

And according to data from the Census and ATTOM, two-thirds of homeowners have a substantial amount of it today.

39% own their home outright without owing anything on it. And another 27% have at least 50% equity in their homes (see chart below):

That’s a big deal. And just in case you’re wondering how that translates into real dollars, Cotality says the typical homeowner has almost $300k in equity today. That’s six figures.

That’s a big deal. And just in case you’re wondering how that translates into real dollars, Cotality says the typical homeowner has almost $300k in equity today. That’s six figures.

And whether you have that much, even more, or a bit less, here are a few examples of how you can use it.

Ways You Could Use Your Home Equity

1. Move Into a Home That Better Fits Your Life

Your needs change over time. Maybe your home is starting to feel cramped, or maybe you have more space than you need now that your adult children have moved out. Either way, you can use your equity as a down payment on a home that’s a better fit for what you need now, and going forward. You may even have enough equity to buy your next house in cash.

2. Upgrade Your Current Home

And if you’re not ready to move just yet, you could reinvest it in your current home instead. Renovations like a kitchen refresh or updated bathrooms could add value when it’s time to sell down the line. Just be sure to talk to a real estate agent before you tackle your project list, so you can prioritize updates that’ll give you the biggest return later on.

3. Fund a Major Life Goal

Equity can also help fund your life goals – whether it’s starting a business, saving for retirement, covering education costs, or helping out someone you love. Some homeowners are even passing down some of that wealth to help fund a loved one's down payment on a home.

4. Avoid Foreclosure in Tough Times

If you’re struggling with payments, your equity can also be a lifeline. Many homeowners who hit financial hardships can sell their homes and walk away with money in their pockets instead of facing foreclosure. If that’s something on your mind, talk to a real estate expert about your options and how your equity can help.

Your Next Steps

If you’re interested in using your equity for one of the reasons above, here’s what to do:

- Step 1: Ask a local agent for a personalized equity assessment on your home.

- Step 2: Meet with a financial advisor if you’re interested in using that equity.

Because when it comes to tapping into this resource, there are a few things you’ll want to keep in mind – like making sure you still have a good loan-to-value ratio (LTV) even if you use some of your equity.

That means, as a general rule of thumb, you want to maintain at least 20% equity in your home as a financial cushion – something many homeowners didn’t know back in the crash of 2008.

The good news is, according to the Intercontinental Exchange, most of today’s equity meets that guideline:

“As of Q4, mortgage holders have $17.3T in home equity, including $11.2T in tappable equity ? accessible via cash-out refinances or home equity lines while maintaining 20% equity in the property . . . ”

Bottom Line

Your home equity is one of the biggest financial assets you have. Whether you’re thinking about moving, remodeling, or working toward a big goal, it’s worth exploring your options. Reach out to a financial advisor to learn more.