When homebuyers begin their research, they want to see all their available options! In many cases, they will include both new construction and existing homes in their search; but is a new construction home really the house of their dreams?

When homebuyers begin their research, they want to see all their available options! In many cases, they will include both new construction and existing homes in their search; but is a new construction home really the house of their dreams?

According to a recent survey by Zillow, of the 38% of total buyers that added new construction to their list, only 11% ultimately purchased a newly constructed home!

They added that 71% of these buyers are repeat buyers who are financially secure, with 45% using the money from the sale of their previous homes to make a purchase.

Below are some reasons why buyers are interested in purchasing a new build:

- Everything in the house is new/never used (49%)

- To be close to family (41%)

- The home is the best value for their money (37%)

- Appealing home features (34%)

- Desirable location (34%)

So, then why did most of the buyers surveyed choose not to purchase a new home?

1) Location

Buyers could not find new construction in the desired neighborhood, and some felt that new construction is not established (e.g., landscaping, community, neighbors).

2) Timing

Buyers face the end of a lease or sale of their previous property and could not wait for a house to be built.

3) Price

Some buyers felt that new construction base prices were deceiving. Adding upgrades and HOA fees no longer made the home fit in their price range.

4) Appeal

For some buyers, new construction homes are too “cookie cutter,” and models are limited. Others feel that the charm and uniqueness of an existing house trumps one that’s never been lived in.

Bottom Line

Not all buyers are looking for a newly built house! There are many buyers looking for “the charm and uniqueness” of an existing home. If you are considering selling your house, don’t wait! Let’s get together to come up with a plan to feature the charming details of your house to future buyers.

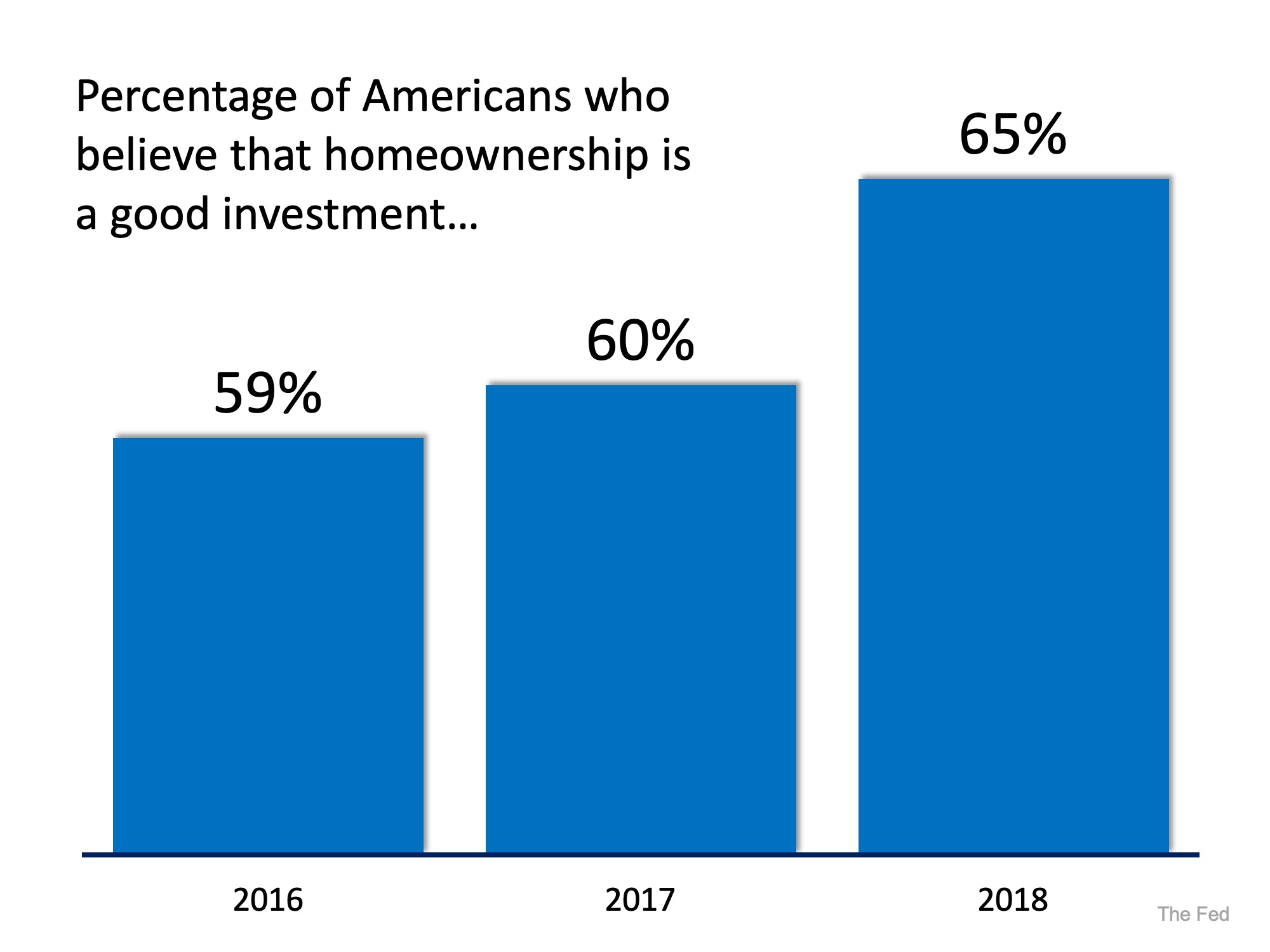

Following last year’s real estate market was like riding a rollercoaster. The market started off strong in 2018 and then softened before finishing with a mild flurry. However, one thing that did not waiver was America’s belief that owning a home makes sense from a financial standpoint.

Following last year’s real estate market was like riding a rollercoaster. The market started off strong in 2018 and then softened before finishing with a mild flurry. However, one thing that did not waiver was America’s belief that owning a home makes sense from a financial standpoint.

One of the most common loans you can get to buy a home is a 30-year fixed rate mortgage. If the thought of paying for your home over the course of 30-years seems daunting, here are some easy ways to shorten that term which will actually end up saving you money over the life of your loan.

One of the most common loans you can get to buy a home is a 30-year fixed rate mortgage. If the thought of paying for your home over the course of 30-years seems daunting, here are some easy ways to shorten that term which will actually end up saving you money over the life of your loan.