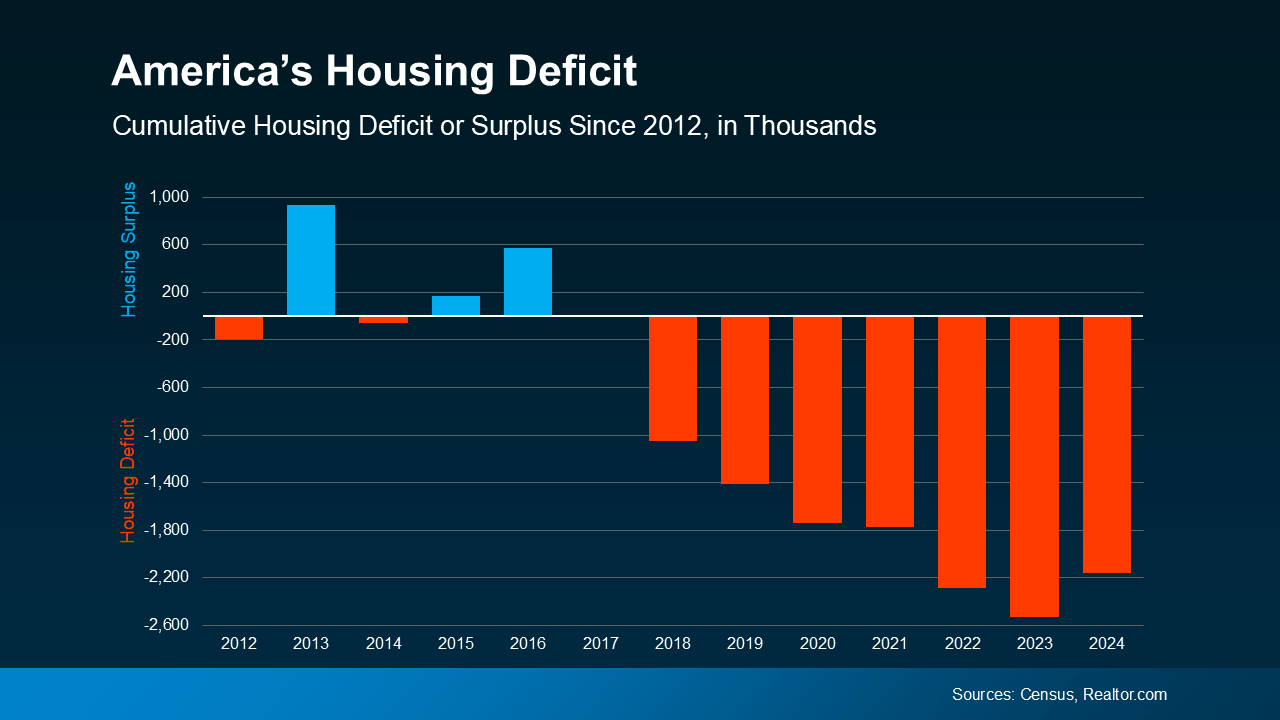

There are plenty of headlines these days calling for a housing market crash. But the truth is, they’re not telling the full story. Here’s what’s actually happening, and what the experts project for home prices over the next 5 years. And spoiler alert – it’s not a crash.

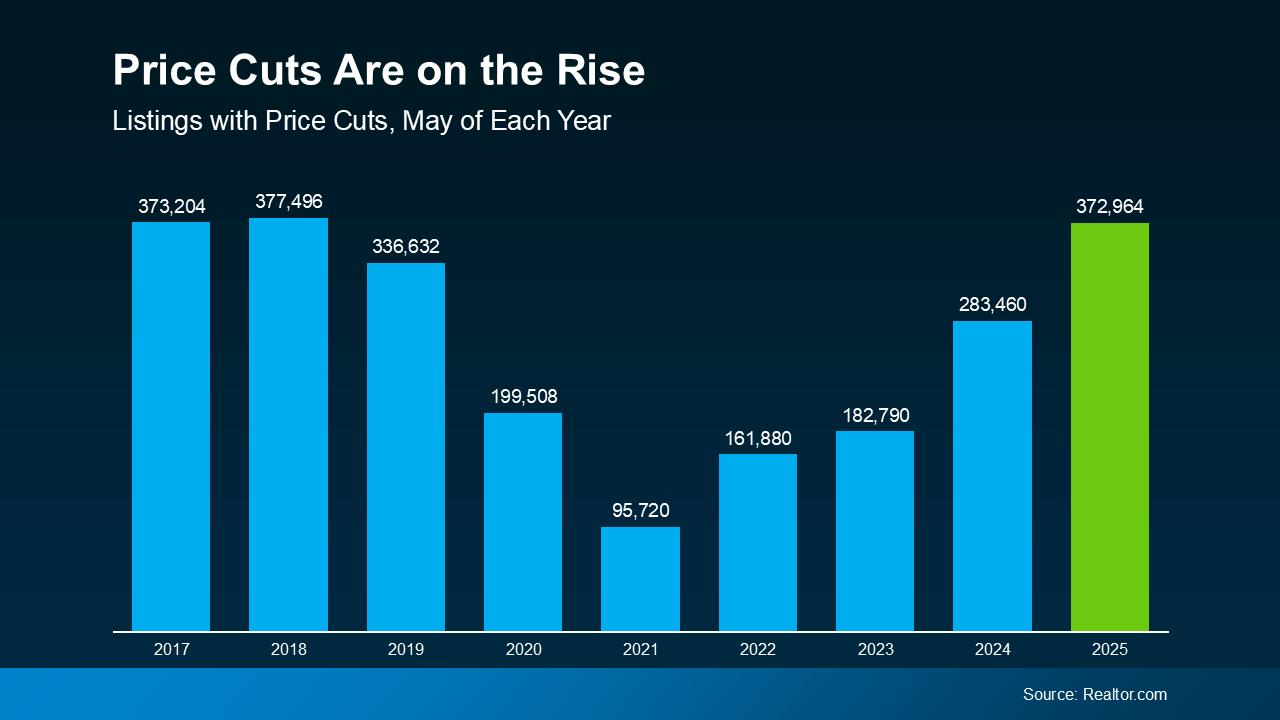

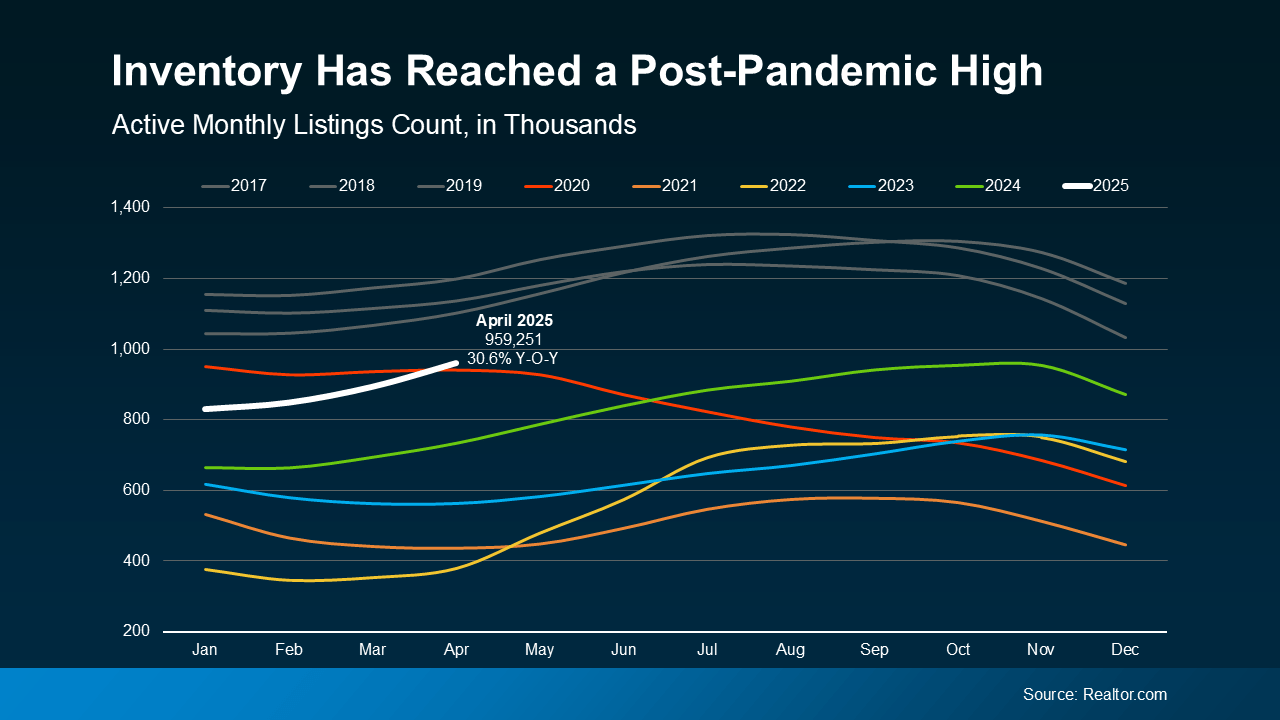

Yes, in some local markets, prices are flattening or even dipping slightly this year as more homes hit the market. That’s normal with rising inventory. But the bigger picture is what really matters, and it’s far less dramatic than what the doom-and-gloom headlines suggest. Here’s why.

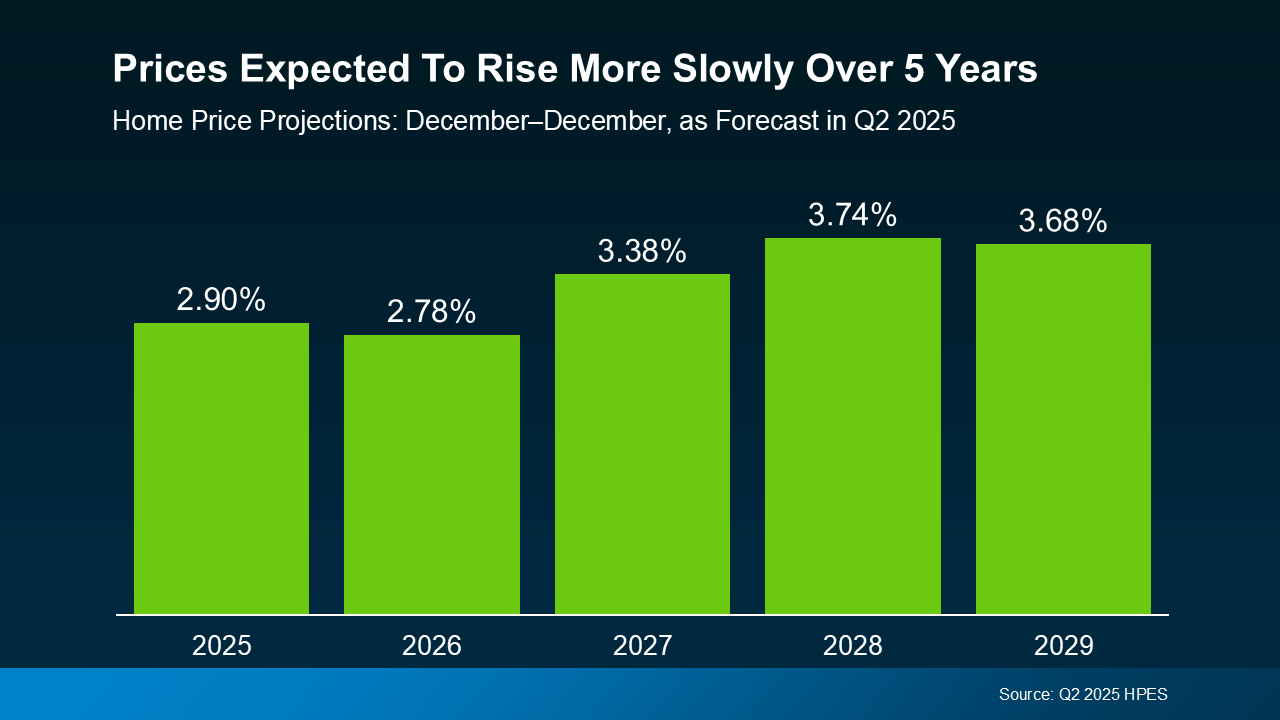

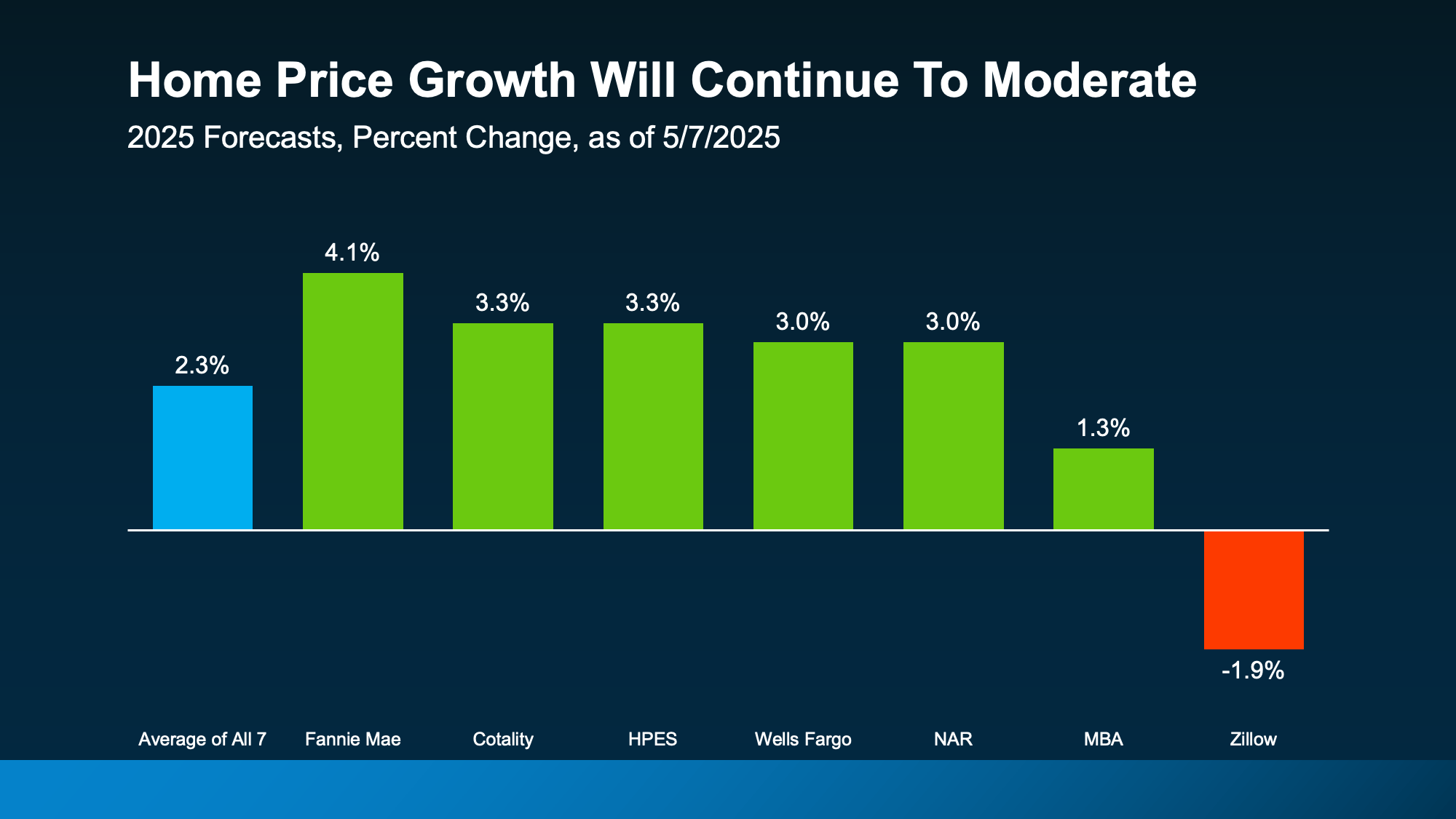

Over 100 leading housing market experts were surveyed in the latest Home Price Expectations Survey (HPES) from Fannie Mae. Their collective forecast shows prices are projected to keep rising over the next 5 years, just at a slower, healthier pace than what we’ve seen more recently. And that kind of steady, sustainable growth should be one factor to help ease your fears about the years ahead (see graph below):

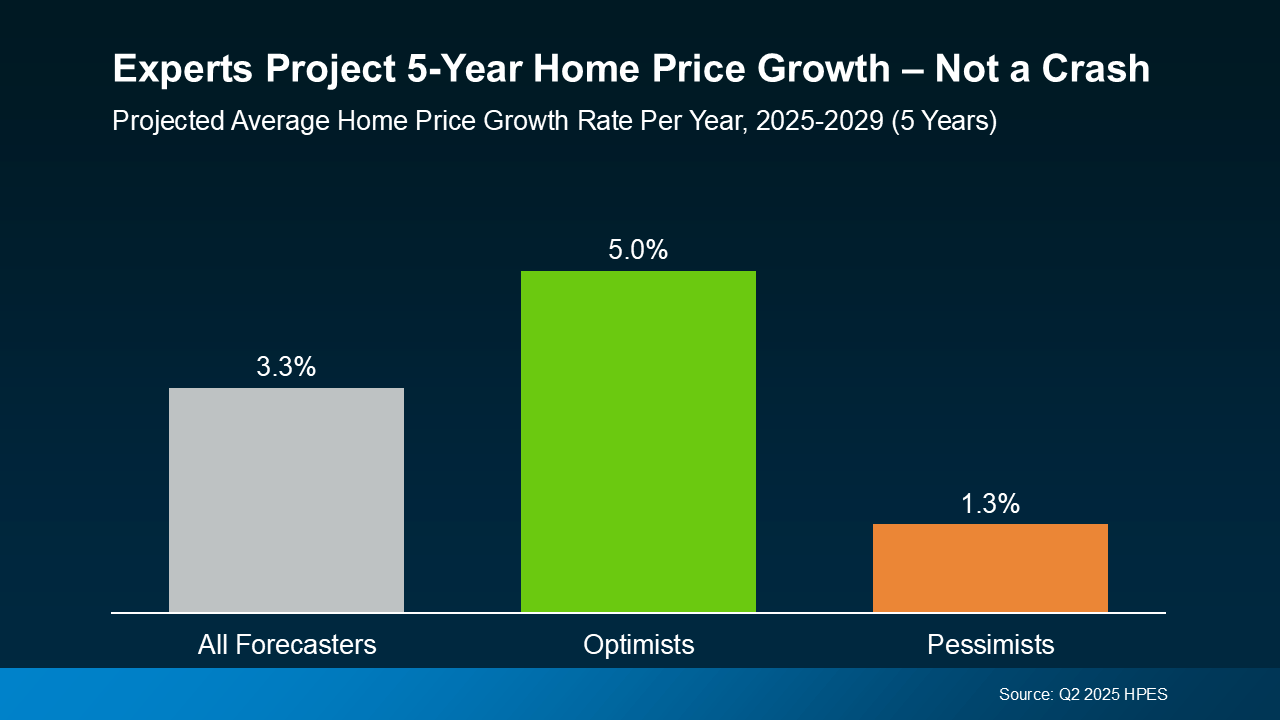

And if you take a look at how the various experts responded within the survey, they fall into three main categories: those that were most optimistic about the forecast, most pessimistic, and the overall average outlook.

And if you take a look at how the various experts responded within the survey, they fall into three main categories: those that were most optimistic about the forecast, most pessimistic, and the overall average outlook.

Here’s what the breakdown shows:

- The average projection is about 3.3% price growth per year, through 2029.

- The optimists see growth closer to 5.0% per year.

- The pessimists still forecast about 1.3% growth per year.

Do they all agree on the same number? Of course not. But here’s the key takeaway: not one expert group is calling for a major national decline or a crash. Instead, they expect home prices to rise at a steady, more sustainable pace.

That’s much healthier for the market – and for you. Yes, some areas may see prices hold relatively flat or dip a bit in the short term, especially where inventory is on the rise. Others may appreciate faster than the national average because there are still fewer homes for sale than there are buyers trying to purchase them. But overall, more moderate price growth is cooling the rapid spikes we saw during the frenzy of the past few years.

And remember, even the most conservative experts still project prices will rise over the course of the next 5 years. That’s also because foreclosures are low, lending standards are in check, and homeowners have near record equity to boost the stability of the market. Together, those factors help prevent a wave of forced sales, like the kind that could drag prices down. So, if you’re waiting for a significant crash before you buy, you might be waiting quite a long time.

Bottom Line

If you’ve been on the fence about your plans, now’s the time to get clarity. The market isn’t heading for a crash. It’s on track for steady, slow, long-term growth overall, with some regional ups and downs along the way.

Want to know what that means for our neighborhood? Because national trends set the tone, but what really matters is what’s happening in your zip code. Let’s have a quick conversation so you can see exactly what our local data means for you.

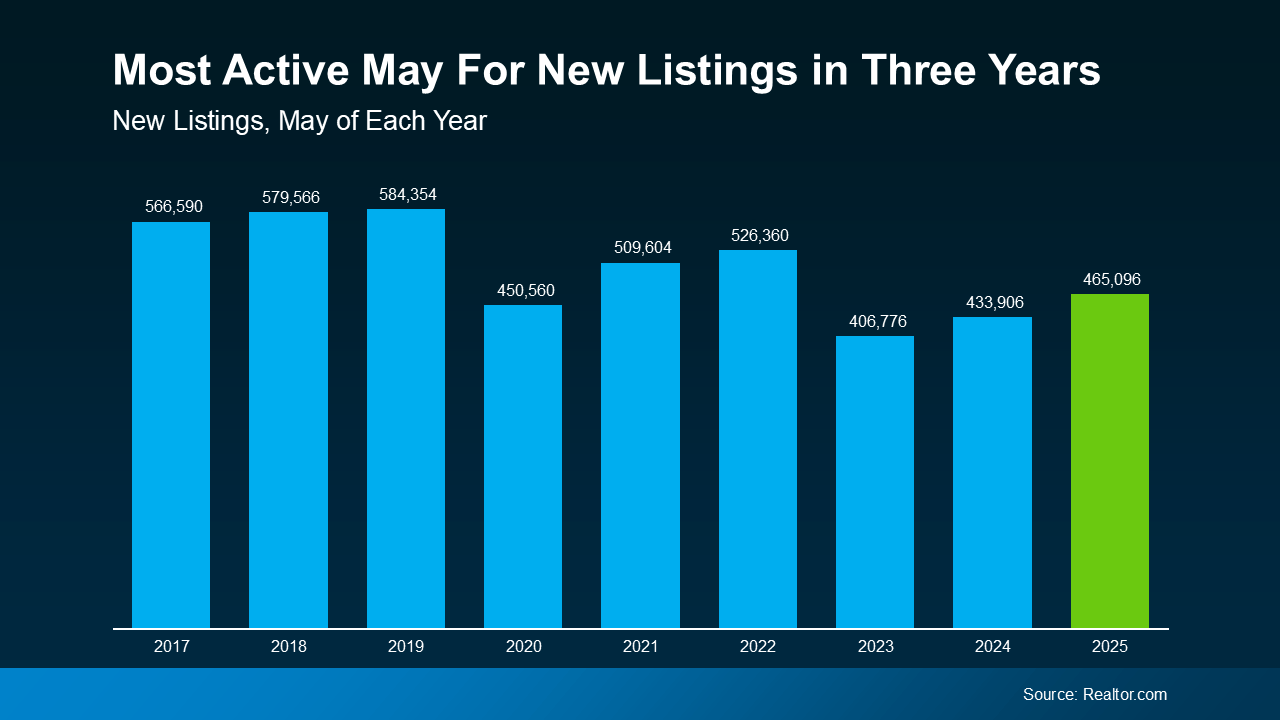

And more homes for sale means more choices.

And more homes for sale means more choices.

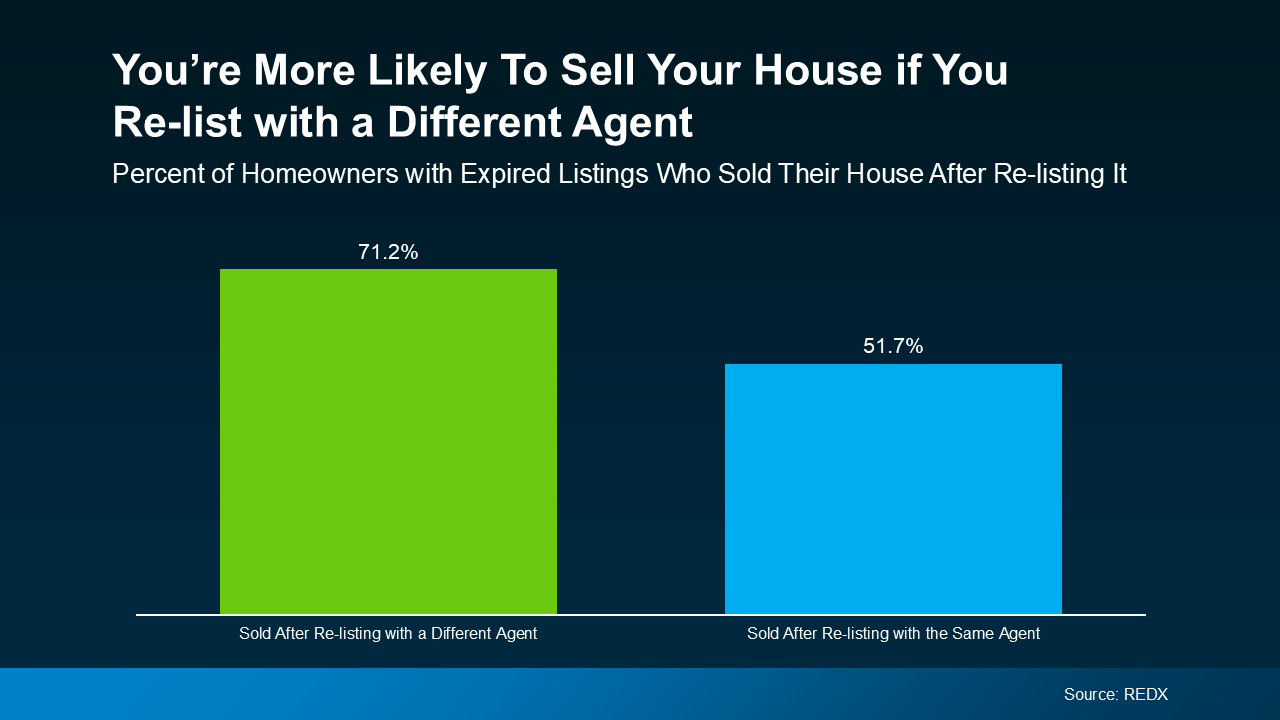

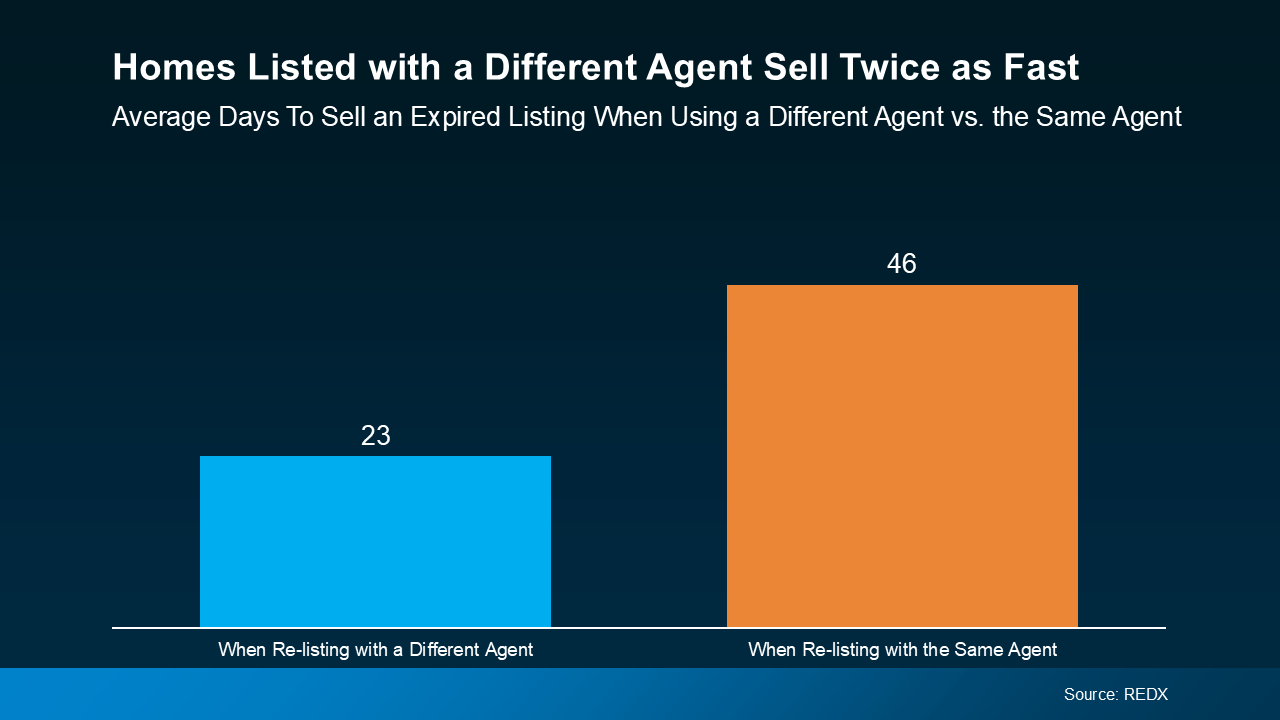

REDX data also shows that only 1 in 3 homeowners with expired listings actually make that change. That means most sellers either give up or repeat the same mistakes, so they get the same disappointing outcome. You deserve better.

REDX data also shows that only 1 in 3 homeowners with expired listings actually make that change. That means most sellers either give up or repeat the same mistakes, so they get the same disappointing outcome. You deserve better. 4. You Weren’t Willing To Negotiate

4. You Weren’t Willing To Negotiate

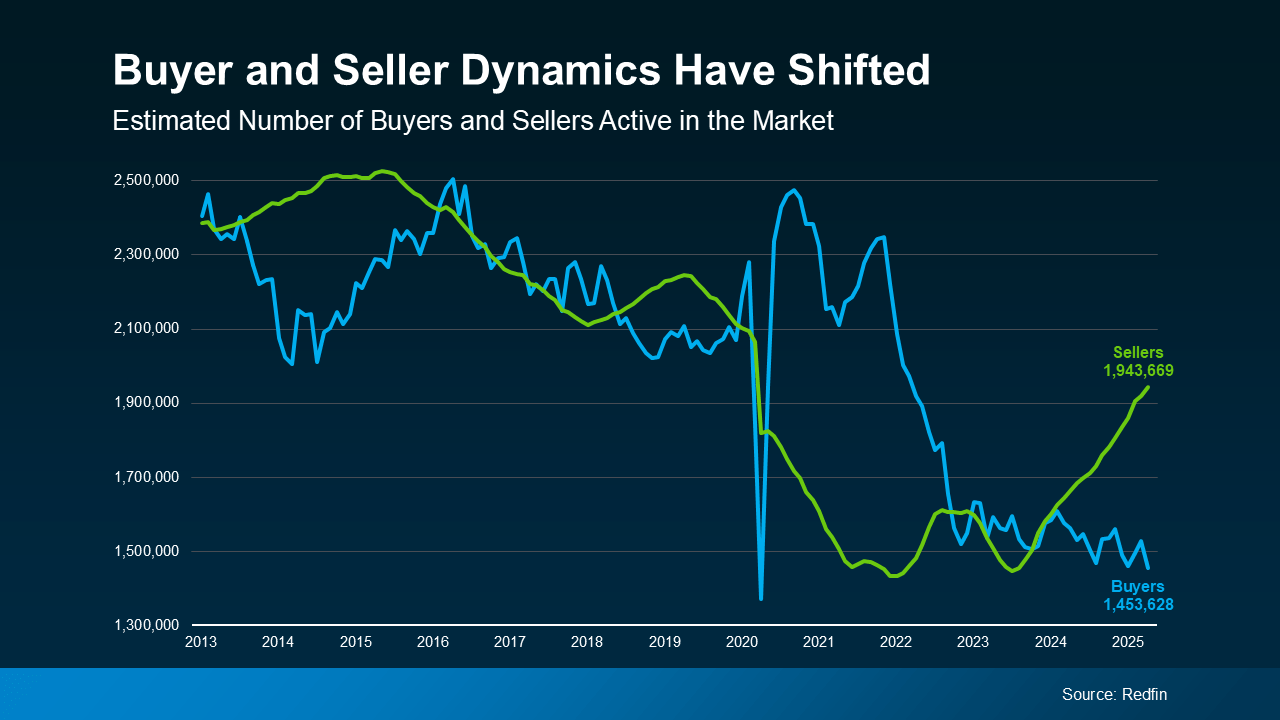

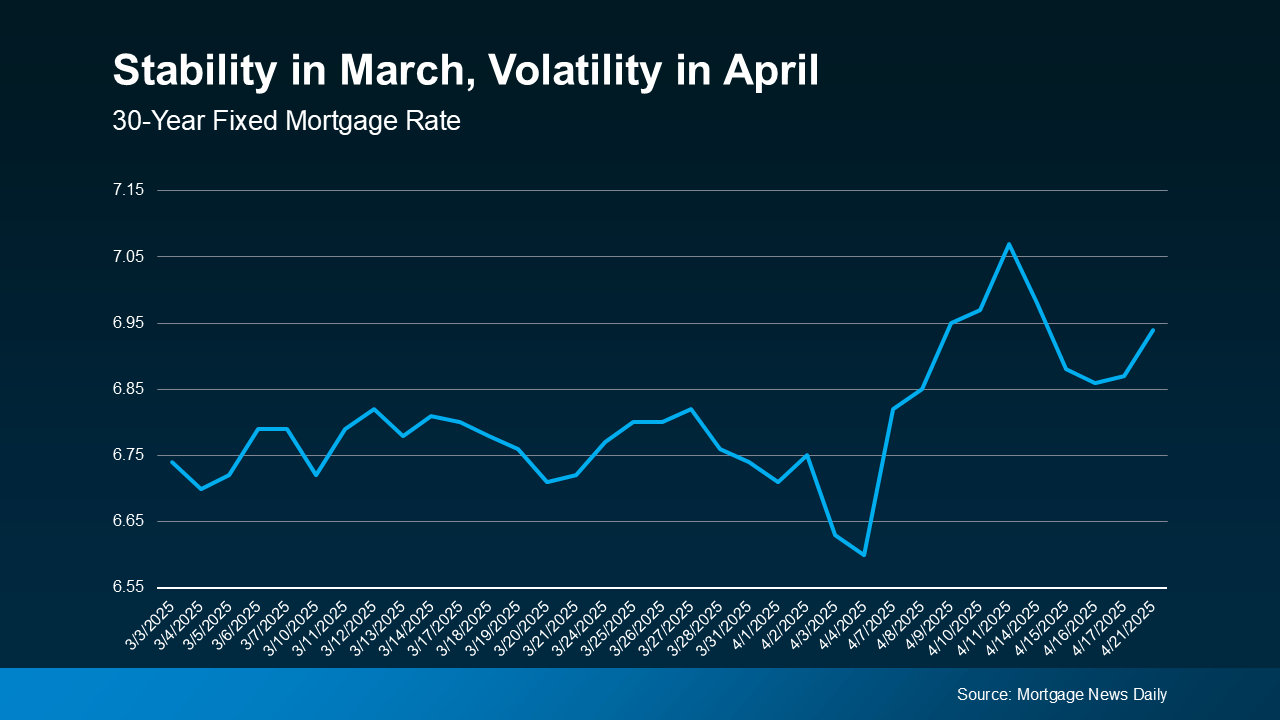

This kind of up-and-down volatility is expected when economic changes are happening.

This kind of up-and-down volatility is expected when economic changes are happening.

For anyone who’s been waiting for more choices, this is exactly what you’ve been hoping for – because more homes coming onto the market means more options and a better shot at finding one that fits your needs.

For anyone who’s been waiting for more choices, this is exactly what you’ve been hoping for – because more homes coming onto the market means more options and a better shot at finding one that fits your needs.